Wildfires present a significant danger to residences and communities worldwide, especially in regions like California, where the risk of wildfires is high. While home insurance is essential for homeowners, obtaining sufficient coverage can be difficult in wildfire-prone areas.

But why is home insurance needed? Well, according to CAL FIRE, California experienced over 5,196 structures damaged and destroyed from 2021 to 2023. As a result, numerous California residents find themselves with limited or even no choices for homeowners insurance, especially those whose homes are situated in areas highly susceptible to wildfire damage.

Many insurance companies offer policies tailored to resilient or “hardened” homes, which can withstand various hazards like wildfires. In this blog, we will discuss what homeowners insurance challenges you might face and how you can make your home hardened enough by installing fire resistant vents, creating defensible zones, using ember-resistant materials and more strategies.

Homeowners Insurance Challenges in High Wildfire Risk Areas

From May 2022 to May 2023, homeowners in high wildfire-risk areas saw their insurance policy premiums increase by an average of 21% upon renewal, as highlighted in the 2023 Policygenius Home Insurance Pricing Report. This significant hike underscores the growing challenges faced by homeowners in regions prone to wildfires. The report further reveals that insurance companies are adjusting their pricing models to account for the heightened risk of fire damage, leading to steeper premiums for those residing in susceptible zones.

Limited Policy Coverage

One of the primary gaps in wildfire insurance coverage is the discrepancy between the policy’s coverage limits and the actual cost of rebuilding or repairing a home after a wildfire. Many homeowners are underinsured, meaning their coverage limits are insufficient to cover the full cost of rebuilding. This is often due to the rising construction costs and the failure to update insurance policies regularly.

Exclusion of Certain Damages

Another gap in coverage arises from the exclusion of certain types of damages. For instance, some policies may not cover landscaping, fencing, or external structures like sheds. Additionally, smoke damage, which is a common aftermath of wildfires, may not be fully covered under standard policies. It’s essential to thoroughly review your policy’s exclusions and consider purchasing additional coverage or endorsements to fill these gaps.

Homeowners Insurance Availability

In regions where wildfires have been frequent and severe historically, homeowners are facing a troubling decrease in the availability of standard homeowners insurance policies. This worrying trend starts from the insurance industry’s mounting concerns about the increasing risks of wildfires and the potential financial strain of wildfire events. Many of these homeowners are finding their coverage options reduced or even denied, leaving them exposed to the economic consequences of wildfire damage.

How to Deal with Homeowners Insurance Challenges?

Dealing with insurance challenges for homeowners can be stressful, but there are several ways you can navigate them effectively:

Wildfire Risk Assessment

Proper evaluation and insuring of homes against wildfire risks is crucial to addressing homeowners insurance challenges, especially in places like California. Insurance companies use thorough methods to assess the risks associated with covering properties in fire-prone regions. This involves analyzing various factors to create a detailed risk profile.

When assessing wildfire risk for a home, insurers consider its location, environmental surroundings, and specific circumstances. These factors include how close the property is to areas with flammable vegetation, the history of wildfires nearby, the availability of firefighting resources, local weather conditions, and the likelihood of ember exposure. Each of these aspects gives valuable insights into how susceptible the property is to wildfire damage.

FAIR Plan

The FAIR Plan is like a safety net for homeowners. It’s there for people who can’t get insurance from the usual places. California backs this plan, but it’s not the same as regular homeowners insurance. It gives basic coverage to help protect homes in risky areas. This includes coverage for the house itself, personal belongings, and liability.

However, it doesn’t cover everything, and the coverage might be less than what regular insurance offers. So, while the FAIR Plan gives some protection, homeowners should think about other options, too, to make sure they’re fully covered.

Renters Insurance

Renters insurance is very important, especially if you’re living in a rental place or WUI (Wildland Urban Interface) areas. While homeowners insurance covers the house itself, renters insurance is all about protecting your stuff and covering you if something goes wrong. With wildfires, renters insurance is a lifesaver because it pays for your things if they get damaged or destroyed in a fire.

It can even help with finding a temporary place to stay if your rental gets wrecked by a wildfire. Plus, it keeps you safe from getting sued if someone gets hurt or something gets damaged while they’re at your place. With wildfires happening more often, renters insurance is like a safety blanket, helping you bounce back if the worst happens.

Home Hardening

Homes in high-risk areas may need help to obtain comprehensive coverage at reasonable rates. In such cases, insurers might ask homeowners to make their homes hardened to get insurance claims. Here are the ways in which you can harden your home:

Creating Defensible Space

Insurance companies might ask homeowners to clear plants and flammable items near their houses. This helps stop fires from spreading easily. By making a safe zone around the house, homeowners can lower the chance of fire damage. These defensible places are divided into 3 zones such as

Zone 0 (Immediate Zone): This area extends up to 5 feet from the walls of your home.

Zone 1 (Intermediate Zone): This zone extends from 5 to 30 feet from your home.

Zone 2 (Extended Zone): This zone goes from 30 to 100 feet (or more, depending on local regulations) from your home.

Using Ember Resistant Materials

During a wildfire, tiny embers of burning material can fly and land on homes, starting fires. Insurance companies might say homeowners need to use materials that don’t catch fire easily, like special roofing, siding, windows, and doors. By using these strong materials, homes are less likely to catch fire, making them easier to insure.

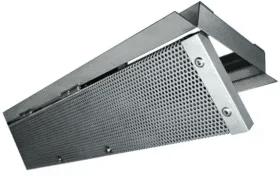

Fire Resistant Vents Installation

Installing fire resistant vents, such as continuous vents, foundation vents, and dormer vents, is a crucial fire safety measure for homeowners in California. These vents are designed to prevent the entry of embers and flames into your home during a wildfire. By upgrading to fire-resistant vents, you not only enhance the safety of your property but also become eligible for lower insurance premiums. Many insurance companies in California recognize the importance of these fire-prevention features and offer discounts to homeowners who take proactive steps to protect their homes against wildfires.

Conclusion

Wildfire-prone areas present unique homeowners insurance challenges in California. As the frequency and severity of wildfires increase, insurance companies are becoming more cautious, leading to gaps in coverage and higher premiums. Many insurance companies want to get your home hardened enough to be eligible for insurance premiums.

One way to harden your home is to install fire resistant vents from Vulcan Vents. Complying with Chapter 7A of the California Building Code (CBC) and tested by ASTM standards, our vents are designed to prevent the entry of embers and flames, a common cause of home ignition during wildfires. Contact Us Today!